In a significant shift that could reshape Canada's housing market, the Office of the Superintendent of Financial Institutions (OSFI) is considering replacing the controversial mortgage stress test with a new portfolio-level approach to risk management. This potential change marks a fundamental transformation in how Canada regulates mortgage lending, moving from individual borrower qualification to institutional portfolio management.

In retrospect, while the stress test appears to have achieved its initial objective of protecting Canada's financial system during the period of low interest rates, the current economic landscape presents new challenges. With emerging inflationary pressures from potential trade wars and tariffs, combined with Scotiabank's recent analysis suggesting limited room for the Bank of Canada to implement significant rate cuts, we're entering uncharted territory.

The Current Landscape

Since its introduction in 2016 and subsequent expansion in 2018, the mortgage stress test has been both praised as a prudent safeguard and criticized as an unnecessary barrier to homeownership. Under current rules, borrowers must qualify at either 5.25% or their contract rate plus 2%, whichever is higher – a requirement that has significantly impacted purchasing power across the market.

The effectiveness of the stress test during the 2022-2023 rate hikes is evident in the relatively low default rates. However, the potential for persistent inflation driven by trade tensions could keep interest rates higher for longer than initially anticipated, potentially requiring a more nuanced approach to mortgage regulation.

This evolving economic environment may justify OSFI's proposed shift to portfolio-level risk management, as it could provide more flexibility in responding to complex market conditions where both inflation and financial stability concerns need to be balanced. The challenge will be implementing a system that can adapt to these new economic realities while maintaining the protective benefits the stress test provided.

Listen to the episode:

The New Direction

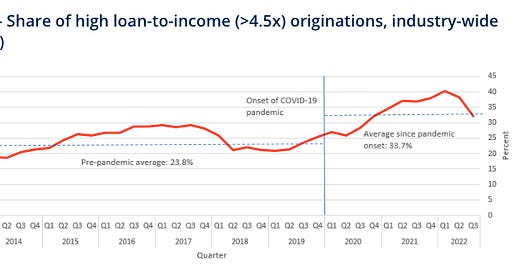

OSFI's proposed alternative represents a sophisticated evolution in regulatory thinking. Instead of testing individual borrowers against hypothetical higher rates, the new approach would limit banks' overall exposure to high-risk lending. Specifically, banks would be restricted to issuing no more than 15% of their quarterly mortgages to borrowers whose mortgage debt exceeds 450% of their annual income.

Interestingly, repeat homebuyers now have the highest share of new mortgages with a loan-to-income over 4.5x, per Bank of Canada.

Investors have the lowest. Both data sets for investors are the least likely to fall into this category, per BOC’s most recent new datasets:

Keep reading with a 7-day free trial

Subscribe to Daniel’s Substack to keep reading this post and get 7 days of free access to the full post archives.