Student Population Surge Meets Canada's Housing Crunch: Unraveling the Numbers

Special thanks to @PHFloor for the support and contributions on this writing journey.

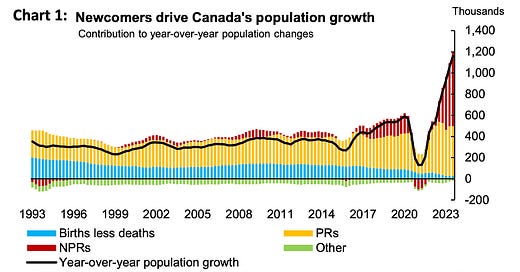

In the daily churn of Canadian news, one cannot escape the startling statistics on population growth. Reports abound with charts, opinion pieces, and firsthand accounts underscoring the strain rapid population growth is placing on an already stressed housing market in Canadian cities – and the concern is entirely warranted.

The only places on earth with population growth as high as Canada are emerging markets. Unlike nations in Africa or other developing regions experiencing explosive population growth due to high fertility rates, Canada's growth is all immigration-driven, predominantly by non-permanent residents, most prominently temporary workers and international students.

A recent chart published by the Bank of Canada nicely paints the nuance of population growth. Natural growth, the balance between births and deaths, is tanking, while immigration, especially in the non-permanent resident category, the one that includes international students, is on what looks like an exponential upsurge.

Tapped out

One thing that really stands out to me here is that we’ve seen PR growth kind of “tapped out”. This could be why Ottawa plans to create Canadian citizenship path for undocumented immigrants, according to the globe and mail.

A lot of people like to mention how population growth is the “bull case” for Canadian real estate, but we’re not seeing growth in Permanent Residents, and those are the ones who are able to buy homes (remember foreign buyers are banned for 2 years). I think you can apply the same logic - but imagine that since the vast majority of population growth is coming from non-permanent residents, all of that growth is appearing in rents. Eventually rent growth should materialize in price growth as rents are the income portion of a property valued through the income approach:

So if cap rates are able to stay the same, investment property valuations should increase accordingly with growth in net operating income (NOI). And honestly, it seems that the recent injection of capital into CMHC’s MLI Select Program has done a pretty good job at setting a floor on multifamily valuations, given that these mortgages provide up to 95% loan-to-value and up to 50-year amortization periods.

Read more: Government of Canada unlocking $20 billion in new financing to build 30,000 more apartments per year

This is really why we haven’t seen cap rates break back into their typical channel about 400-600bps above the Canada 10-year bond yield - they don’t depend on those bonds, they depend on Canada’s discounted MBS program and a very unique credit product. Any correction that should have appeared in pricing has basically been pushed out and de-risked by owners into massive amortizations.

Some context

So, how unusual are Canada’s recent YoY population growth statistics? The chart below shows the rate of change, or speed of change, relative to our southern neighbors and G7 peers, and the African continent. One thing is obviously not like the others.

The whipsaw action in Canada’s population growth trajectory, mirroring the volatility felt in various aspects of our lives due to the pandemic, is evident in the charts below, illustrating the growth in the rent of shelter component of CPI. Pre-pandemic, rental rates were already edging up, and since then have ballooned, well surpassing historical growth norms over the last 23 years. The rent component of CPI, a big piece of households’ expenses, is moving in the opposite direction of overall CPI.

Something is amiss here.

Higher prices and instability in the rental housing market raises tough questions for policymakers: What is causing it, why isn't it being fixed, and more importantly, are their policy actions, or non-actions, fueling the fire?

While it is true that international student numbers can’t fully explain rent price increases, it would be exceedingly difficult at this point to argue that they are not at least contributory.

Postsecondary education is big business

Canada's higher education sector is experiencing a financial windfall, driven by a surge in international students. According to Charlotte Littlewood, Head of the UK-India Desk for the International Centre for Sustainability: “Canada makes 22.3 billion dollars from tuition fees, that is more than their most major export (auto parts) at 19.2 billion. 76% comes from international students.”

Ontario takes the biggest share with more than half of all international students choosing Ontario as their destination of choice. The chart below illustrates the spread between Canadian and international students in Ontario. The international student share has risen from 4% in the 1992/1993 academic year to 30% in 2021/2022.

Source: https://cbie.ca/infographic/

What’s the big business part of this? In one word: fees. While tuition fees for Canadian students have barely budged, since the 1990s, fees for international students are on an exponential climb, particularly in the undergraduate category as depicted in the chart below. Advantageous for postsecondary educational institutions, no? Their high margin customer base has grown while their low margin customer base has fallen off.

The India Twist

Media reports recently highlight a remarkable statistic – a 20% decline in international student visa applications of late, most notably a 40% drop in the reliable Indian component. The reported decline aligns, at least in timing, with growing tension between Trudeau and Modi over allegations of high-level Indian involvement in the death of a B.C. Sikh leader. While geopolitical posturing is largely immaterial in my view, the media can’t help but to capitalize on these narratives. But that is par for the course in today’s world of infotainment.

But make no mistake about it, Indian nationals have become a huge part of the international student demographic in Canada. The infographic below shows where the Canada’s international students come from, followed by a chart that shows the top six countries that have fed international student population growth in Canada since 2015 as reported by IRCC. The 2023 academic year is reported up to the end of October, so we don’t have the full picture for this year yet.

Source: https://cbie.ca/infographic/

Nonetheless, what’s noticeable is that China, Canada’s previously main source of foreign students was eclipsed by India in 2018, and the spread between the top two feeder countries has surged in favor of India since.

Contrary to alarming media reports, a look into the IRCC numbers reveals that student visas issued to Indian nationals in 2022 amounted to 225,865, with 208,630 year-to-date in 2023. December is usually big month for student visa issuance. It is reasonable to estimate numbers from India are likely to at least match 2022’s, if not surpass them. But we shall see.

These figures, considered in aggregate, show that international student visas are still on the rise. As of October 2023, IRCC reports 553,675 international student visas issued, up from 2022’s 548,875 full year number.

The Way Forward

There appears to be a consensus forming that slowing or capping international student growth in line with Canada's capacity to comfortably accommodate them makes perfect sense. In fact, Three in four Canadians say higher immigration is worsening housing crisis. Addressing Canada's housing crisis is imperative, and careful consideration of the facts by policymakers is crucial at this juncture and boy would actions would speak louder than words right about now.

And the demand side is an easier fix here than the supply side.

Magnitude: The investment thesis

One of my thoughts around this is that a lot of people dismiss magnitude when they evaluate population growth in areas they’re thinking about investing. For those who believe that excess demand is the driving bull case for real estate in Canada, it would be worthwhile to examine where in Canada that excess demand is most pronounced. While most of the immigration ends up in the GTA, on a percentage basis, many areas are growing faster, especially relative to housing supply growth. Fraser Institute recently did a report on this, some of the findings are below. We will cover the supply/demand imbalance much more exhaustively in future reports: