Ontario Rent Control and the New Politics of Housing

The Ford government’s reversal of proposed rent control reforms highlights the growing influence of renters in shaping housing policy and the risks investors face in a politicised market.

In late October, the Ontario government proposed reviewing security of tenure, the rule that allows leases to automatically continue after the first year and forms the backbone of Ontario’s rent control system. The sudden reversal on this, announced only the previous week, was more than a tactical retreat. It was an unambiguous signal of how fragile Ontario’s housing politics have become. By even suggesting that security of tenure might be reviewed, the government ignited a wave of backlash that dominated the news cycle and forced a ministerial climb-down within days.

What was framed as a consultation on lease expiry was widely understood as an assault on tenant protections. Tenant groups mobilised quickly, media channels amplified the concerns, and the political cost became clear. The incident illustrates a defining truth of Ontario housing policy. Political forces now override economic logic, and tenant rights have become an untouchable pillar of the rental market.

Don’t want to read the whole thing? Watch the breakdown in the video below:

The Rise of the Renter Vote

For decades, Canada’s electoral arithmetic rewarded policies that catered to homeowners. Two thirds of households own their homes, and this majority made homeowner-focused policy the path to power. That calculus is changing. In Toronto, half of households rent, and across Ontario the renter share is growing.

As tenant households expand, so too does their political influence. The reversal on rent control demonstrates that governments can no longer design housing policy by privileging owners and investors alone. Olivia Chow’s victory in Toronto underscored the same reality. Pro-tenant policy is no longer a fringe position but an electoral asset. Governments at both provincial and federal levels will be forced to balance competing blocs of owners and renters with unprecedented delicacy.

For readers seeking a practical breakdown of how rent control functions in Ontario, I recommend the detailed explainer I authored on the Valery website.

Policy Risk as a Structural Force

Investors often model interest rates, cap rates, and demand cycles. Few model legislative risk with equal rigour. Yet recent years have shown that policy can alter market fundamentals overnight. Ontario has imposed foreign buyer taxes, municipalities have regulated Airbnb out of existence, and the federal government has enacted outright bans on non-resident purchases.

The rent control reversal adds to this pattern. Investors must now contend with a political environment in which policy risk is not an outlier but a structural feature. The economics of a building can be upended not by market dynamics but by a single announcement. For capital allocators, this makes prudence and diversification essential.

The Real Crisis Lies Elsewhere

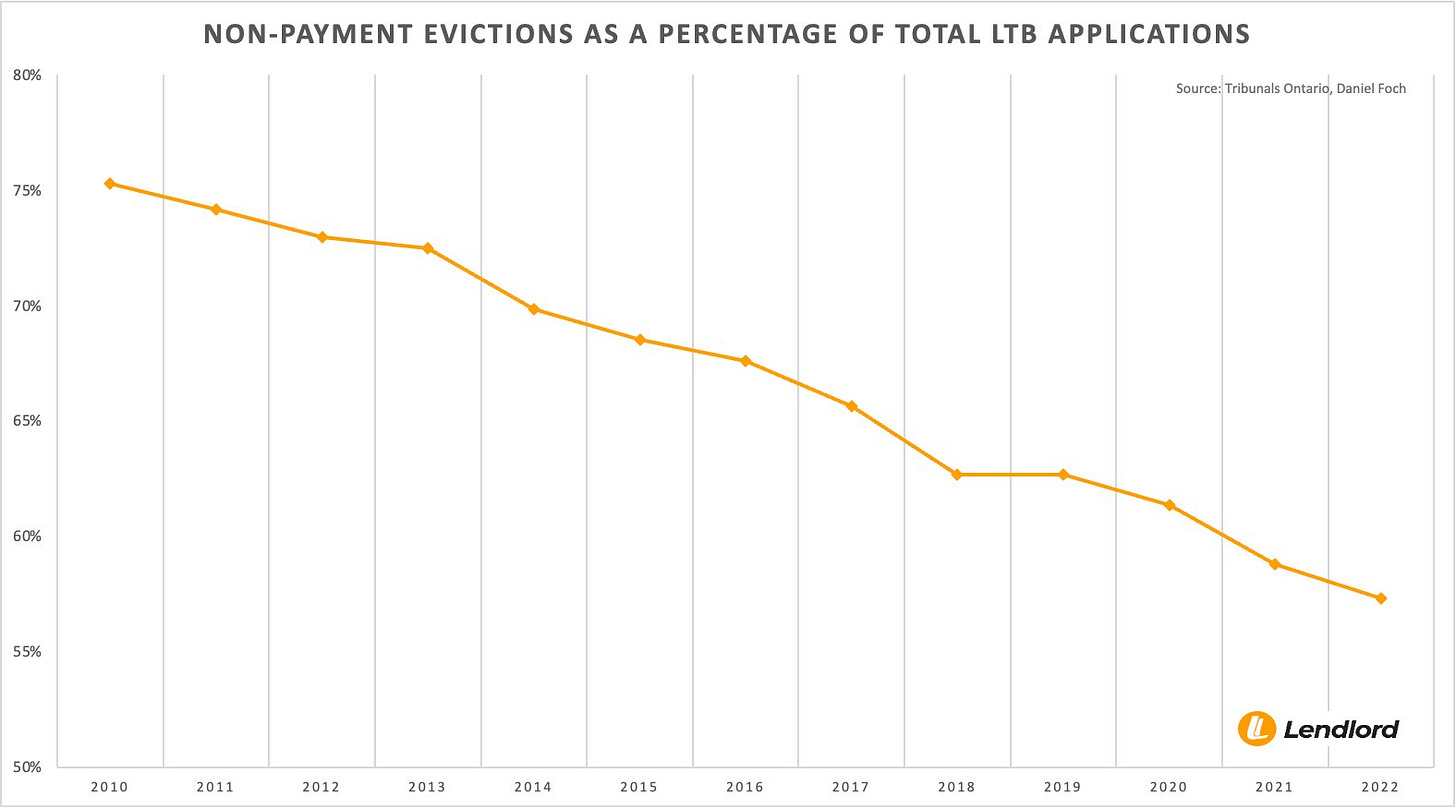

The uproar over rent control has diverted attention from a deeper crisis. Ontario’s Landlord and Tenant Board is paralysed by more than 50,000 active cases, leaving both landlords and tenants in limbo. Disputes are no longer dominated by simple non-payment. In 2010, three-quarters of all applications stemmed from unpaid rent, but by 2022 that share had fallen to 57 percent. The tribunal’s inability to deliver timely rulings has eroded confidence on every side of the rental relationship.

At the same time, Ontario’s housing construction pipeline is faltering. Unfavourable interest rates, escalating costs, and regulatory delays have throttled new housing starts. When current projects are completed, the trades face job losses and the economy faces a drag from one of its most vital sectors. The Fighting Delays, Building Faster Act contained meaningful measures to address these problems, but they were eclipsed by the firestorm over rent control.

Where Ontario Housing Policy is Heading

Sweeping reforms are unlikely to survive in this political climate. Instead, Ontario will likely pursue more surgical measures. Fixing the Landlord and Tenant Board, incentivizing purpose-built rentals, accelerating approvals, and rethinking development charges are the levers most likely to be pulled. These measures can improve supply without triggering a political crisis.

For renters, the backtrack is reassurance that security of tenure remains in place. For landlords, it is a reminder that the tribunal’s dysfunction is the greater challenge. For investors, it is another illustration that the greatest risk is political rather than economic.

Conclusion

Ontario’s rent control episode revealed the precarious balance between politics and economics in housing policy. Tenant protections are politically untouchable, yet the institutions meant to enforce fairness are broken, and the construction engine required for long-term stability is slowing.

The province cannot abandon tenant rights, nor can it ignore the necessity of new supply. The next phase of Ontario housing policy will be defined by whether governments can navigate this tension with reforms that restore trust and unlock growth. For investors, tenants, and policymakers alike, the lesson is clear. In Ontario, housing policy is no longer shaped by markets alone. It is shaped by the politics of survival.

If you want to keep up with the data that shapes Canada’s housing market with practical insights for stakeholders, subscribe to this newsletter. I’ll continue breaking down the numbers that matter.