Capital gains tax increase vs. real estate investors

Tax change could reduce resale housing supply and cause further hoarding

An in-depth report and video version of this analysis will be available for premium members at realist.ca.

The Canadian Government increased capital gains tax exposure, and I think they overlooked a few negative impacts this could have on the housing market.

The changes have been pretty controversial, garnering response from some of Canada’s biggest X accounts, such as Tobi Lutke, CEO of Shopify, once Canada’s most valuable company.

Because it applies absolutely to corporations, this capital gains tax obviously has far-reaching implications for entrepreneurship and business growth in Canada. Fortunately for you, that’s not something I’m well-versed in, so I’m going to be talking more specifically about how I think this change could impact the real estate market in Canada.

Tax Fairness

Let’s start with the government’s own summary on this tax. This comes from “Tax Fairness for Every Generation”, a new page on the Department of Finance website:

"To make Canada's system more fair, the inclusion rate—the portion of capital gains on which tax is paid—for capital gains for individuals with more than $250,000 in capital gains in a year will increase from one-half to two-thirds. Individuals will continue to only pay tax on 50 per cent of any capital gains up to $250,000 per year.

The inclusion rate will also increase to two-thirds for all capital gains realized by corporations and trusts.

The new rules will apply to capital gains realized on or after June 25, 2024.”

The last line is pretty important, to be fair. Later in this post I describe that we’re already seeing a rush to sell, and it’ll likely be done in vain, given that you actually only have to pay the increased tax on gains created after June 25th.

This isn’t new, by the way. In the 1990’s, the capital gains tax inclusion rate increased from 50% to 66% and then to 75% for quite a while. It is among the long list of factors included in a discussion around the brutal recession Canada faced in the 1990’s, with several tax increases instituted by the federal government between 1989 and 1995 that are thought to have had a negative impact on GDP growth and productivity.

The “0.13%”

Many people anticipated a “wealth tax” would be included in this Federal Budget, with the objective of evening the disparate economic gap between older generations and the struggling Generation Z. On brand with that messaging, the tax is positioned as a tax on the “top 0.13%” of Canadians, which seems a little disingenuous to me:

“Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.42 million are expected to pay more personal income tax on their capital gains in any given year.”

If my understanding is correct, they’re implying that only 0.13% of the population will sell an asset and realize a capital gain substantial enough in size to be impacted by this policy. Based on this, if my math is correct, they’re stating that 53,300 Canadians per year will realize a qualifying capital gain where the income would push them over $250,000 annual threshold. I assume they’re basing this on an average of capital gains filings of this size from the last few years.

Objectively, I have no real problem with an actual wealth tax, but I think this policy falls short of that, and ignores a potential negative externality it creates.

The problem I see now is that this ignores pending capital gains, a key friction factor in Canada’s housing market. The “rich” people they’re allegedly targeting hold most of the houses, and frankly, many of them are not “rich” and certainly not the “top 0.13%”, though they would appear in that tax bracket for one year when they sold an asset and realized those capital gains, which are taxed at their income tax rate for that year. In that year, they’d become one of the 53,300 Canadians in the “0.13%”.

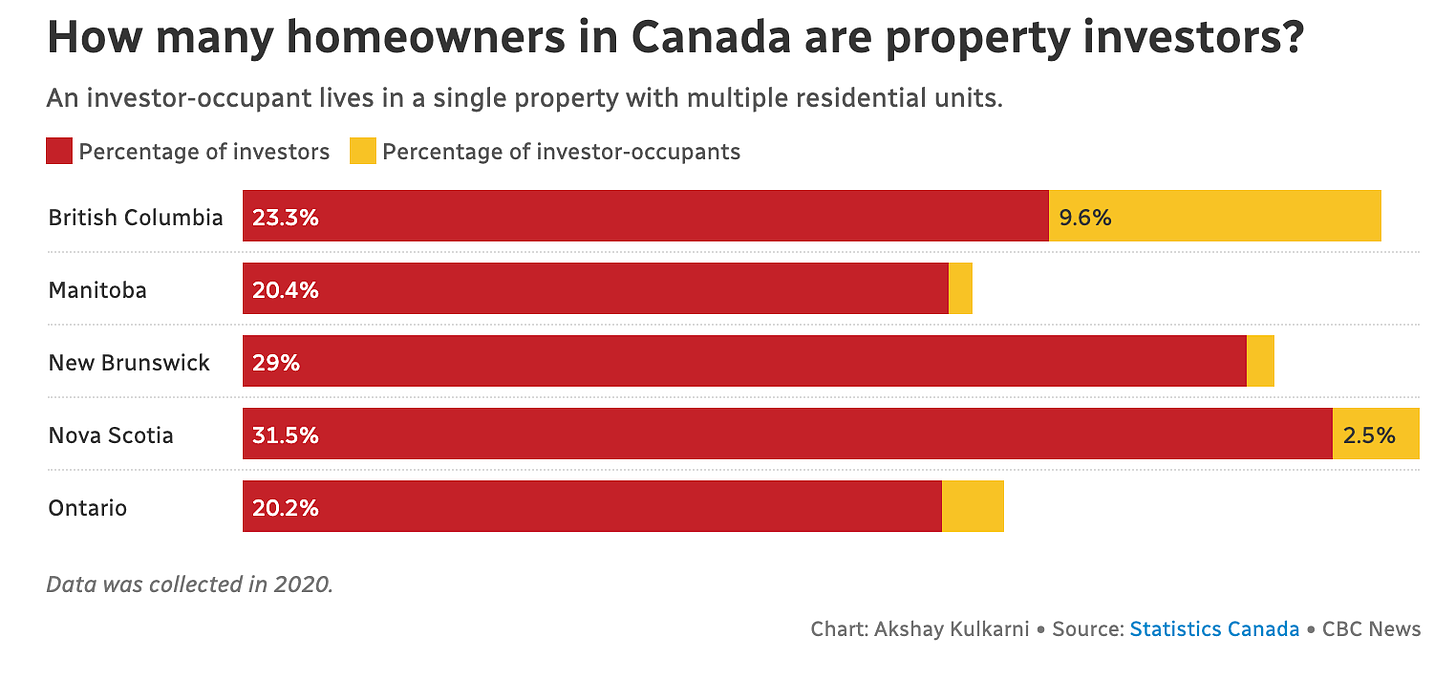

Recent data provided by Statistics Canada indicates that a significant portion of all residential properties in Ontario, British Columbia, Nova Scotia, and New Brunswick were owned by individuals or entities possessing multiple properties. The percentage of housing stock owned by these multiple-property owners ranged from 29 to 41 percent.

From what I could find, the average ownership length of a property in Canada seems to be around 5-7 years, when including both investment and primary residence (this data point is likely skewed down by primary residence). Even if we assume 5 years, which would be a short timeline for an investment property, the average Canadian House Price has gone up 38.4% in that period of time, from $445,000 to $718,000, with an average capital gain of $273,000, tragically (or conveniently?) above the $250,000 annual threshold. Be mindful that this is the average, much of these gains will be higher.

This means that on average, assuming a very short investment horizon, a lot of property sitting in the market would be have gains above the $250,000 threshold, meaning their tax burden is increasing. Combining this data in an extremely hasty, statistically improper, and probably reckless way, it would be reasonable to guess that somewhere around 10-20% of Canadian real estate would have a pending capital gain that just got meaningfully more expensive to liquidate.

But this “multiple property owners” statistic just measures names that appear on more than one property title, and excludes another key factor: corporations.

The “39.7%” - Corporations

In the initial quote above, it is mentioned that for corporations “The inclusion rate will also increase to two-thirds for all capital gains realized by corporations and trusts.”

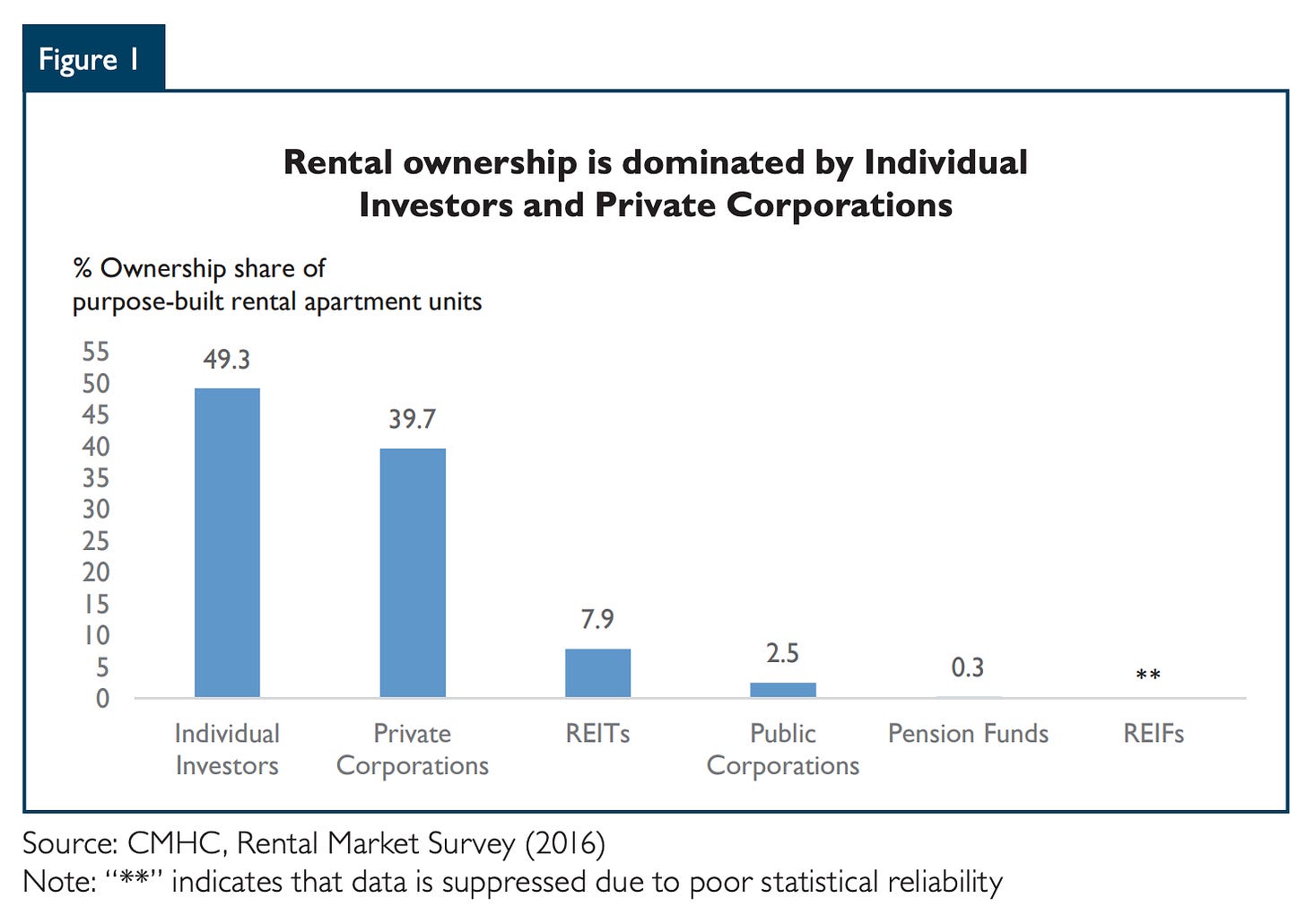

CMHC’s 2016 rental market survey found that after individual investors, 49.3% of owners, rental ownership was very much dominated by Private Corporations, owning 39.7% of rental apartment units.

Statistics Canada found that “in Ontario, three-quarters (75.0%) of non-individual owned properties are held by corporations, compared with 68.9% in Nova Scotia and 57.3% in British Columbia. The share of non-individual owned properties held by governments is highest in British Columbia (39.0%), followed by Nova Scotia (22.9%) and Ontario (20.1%).”

Statistics Canada also states that the share of housing held by corporations and institutions for Ontario was 7.6%, and British Columbia 10.0%, and these were the only provinces with that data available.

Let’s be generous and take the 7.6% Ontario figure. Adding that to the 10% of multi-property owners who likely would realize the capital gain above the $250,000 threshold, it would not be unreasonable to assume that somewhere between 5 and 10% of all housing in Canada just saw their tax burden of their pending capital gain increase by about 8%

But let’s remember… this is being positioned as a tax for the 0.13%. And honestly, I agree with that. By increasing the tax burden of selling real estate, they’ve found a great way to make sure that fewer individuals in Canada sell properties and realize a capital gain above $250,000.

After June 25, 2024, they’ve been all but disincentivized the aforementioned property owners to sell.

Moar hoarding?

Young people need affordable housing. I’ve been a fervent participant in the distribution of that message to the public and politicians. In order to deliver that, we need more housing supply or less housing demand (which isn’t going to happen).

Supply can come from new homes or existing homes. To date, we’ve failed to deliver on the new home front, though I’m optimistic that could change slowly with policy directions including Canada’s New Housing Plan. I had a public conversation with Canada’s Housing Minister about this.

Existing supply is owned, for the most part, by legacy real estate investors like the ones I mentioned before. Many of these investors are older, as they purchased properties a long time ago, and they depend on the assets’ cash flow and capital gains as part of their retirement plan.

These investors are regularly demonized for hoarding assets (especially houses) that could be purchased by. Here’s the kicker. This tax could exacerbate that house-hoarding. Switching costs were already a leading prohibitive factor in resale supply reaching the housing market in Canada. Those switching costs just got more expensive for many investors. So, let’s ask ourselves, why would they sell?

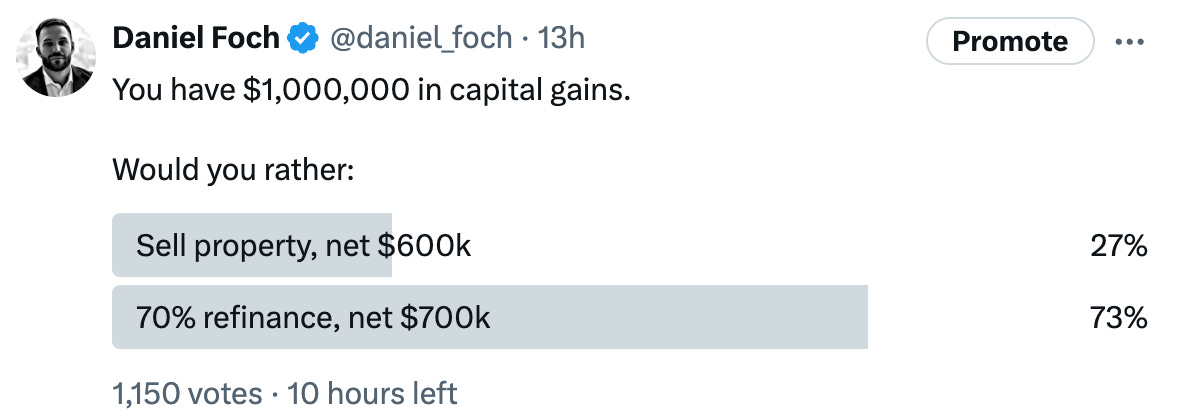

To simplify things, let’s assume you own a property you paid $1 for, and it’s worth $1,000,000 now. Obviously not a likely scenario, but an easy one to illustrate. You have 2 options.

Sell the asset: you pay switching costs (5%+HST, legals, mortgage discharge penalties, etc) and realize a capital gain of $925,000. You now pay about $275,000 to 325,000 in capital gains assuming you’re in the top tax bracket (higher bound for corporations), assuming the step-up is about 8% higher tax amount more than you would have paid before, which is what I’ve gathered from accounting professionals. In this example, you would net $600,000-$700,000.

Keep the asset: provided you have equity in the property and it can cash flow above a DSCR of 1.25, you can conservatively get a mortgage on the property for 70% loan-to-value, allowing you to take $700,000 in equity out of the property. The cash flow from renting the property would. In this scenario, you would net a similar amount of $600,000-$700,000, and you’d get to keep the asset with $300,000 in equity against it. You may also invest the capital you got from refinancing the asset and tax deduct the interest cost against the investment returns, known as the Smith Manoeuvre. The Smith Manoeuvre is a legal tax strategy that allows your mortgage interest payments to become tax deductible.

Apparently, the vast majority of investors would rather keep the asset than sell it.

Race to the exit:

So, unfortunately, there’s a pretty solid chance that this tax policy could disincentivize anyone above the average capital gain scenario. But until then, it seems like there might be a race to the exit for sellers who want to get out before the rate increases on June 25th:

Not all is lost, though. There are some decent proposals in Canada’s New Housing Plan that could compel these newfound house-hoarders to convert their assets to multiplexes, including an accelerated capital cost allowance, loans for multiplexes, and modular garden suites. More on that here:

Daniel , do a thread on CRA linking consultation with mortgage brokers to creat a tool to circumvent mortgage fraud speech by liberal govt. do you think this will ever happen and if yes then what u see how will market react ?